The latest report from John Gilbert, JGFR, on the public’s attitudes and feelings towards Brexit – and how it is affecting their lives…

For millions of Britons January 31 2020 will have been one of the saddest days of their lives. Many will have grown up and prospered as a European citizen enjoying the warmth and hospitality of our nearest neighbours. The 75th anniversary of the D-Day landings last June was testimony to the sacrifice so many young people made in fighting to bring Europe together and marked the second time in the 20th century that World War ravaged the continent.

In 1975 following a recommendation by Prime Minister Harold Wilson of accepting new negotiated terms of European Community membership, 17.4 million people (64%) voted to remain in the EC and just 8.5 million (36%) to leave on a 65% turnout. Then only 9 countries were EC members.

Over the subsequent 44 years Britain and Europe have become ever more closely integrated, with the construction of the Channel Tunnel linking Britain to Europe by land and millions of Britons holidaying and working in Europe with millions of Europeans moving to the UK to work, study and

travel. English is the most widely spoken language in the EU.

No New Year Boris confidence bounce

The decision to leave the EU taken in the Referendum of June 2016 continues to divide the UK. The final Consumer Confidence Barometer (CCB) undertaken by GfK for the European Commission in January, along with the final YouGov /Times tracking poll, highlights divisions across generations,

regions and socio-economic classes.

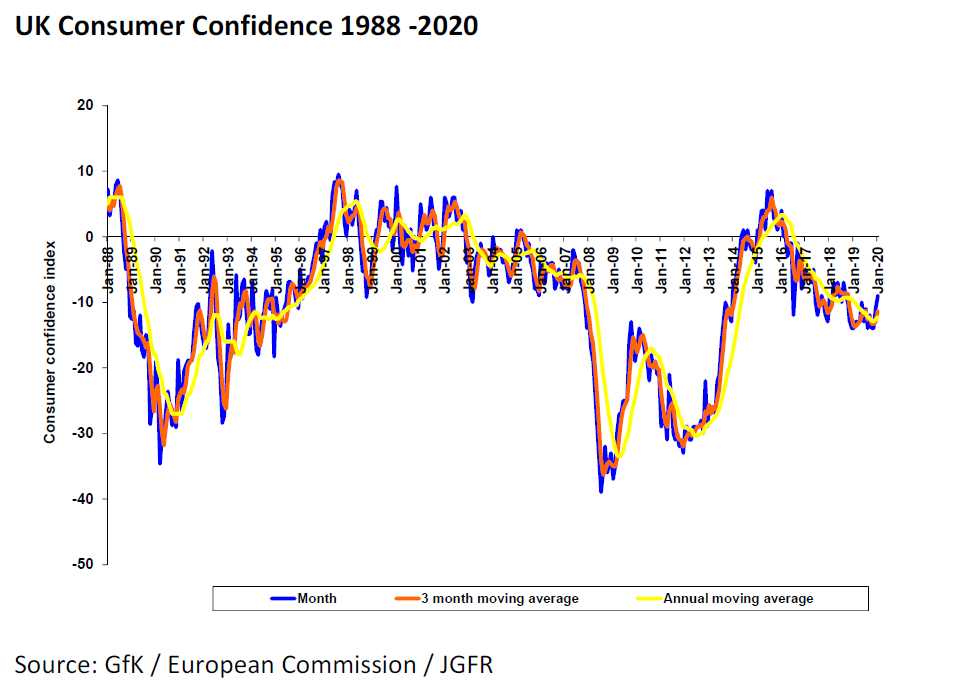

As expected consumer confidence improved in January by 2 points to -9, an 18-month high, but surprisingly there is no discernible ‘Boris’ bounce following the conclusive ‘Get Brexit done ‘ general election. Since 1989 confidence has only fallen 5 times between December and January with the

average jump in ‘up’ years around 5 points reflecting the optimism of a new year.

The biggest new year jump was in 1993 (10 points) following the UK’s exit from the Exchange Rate Mechanism in October 1992 which highlighted the fact that a semi-detached relationship, not tied by monetary union with Europe, was more popular, a status confirmed by the Labour government

opting out of adopting the euro in 2007.

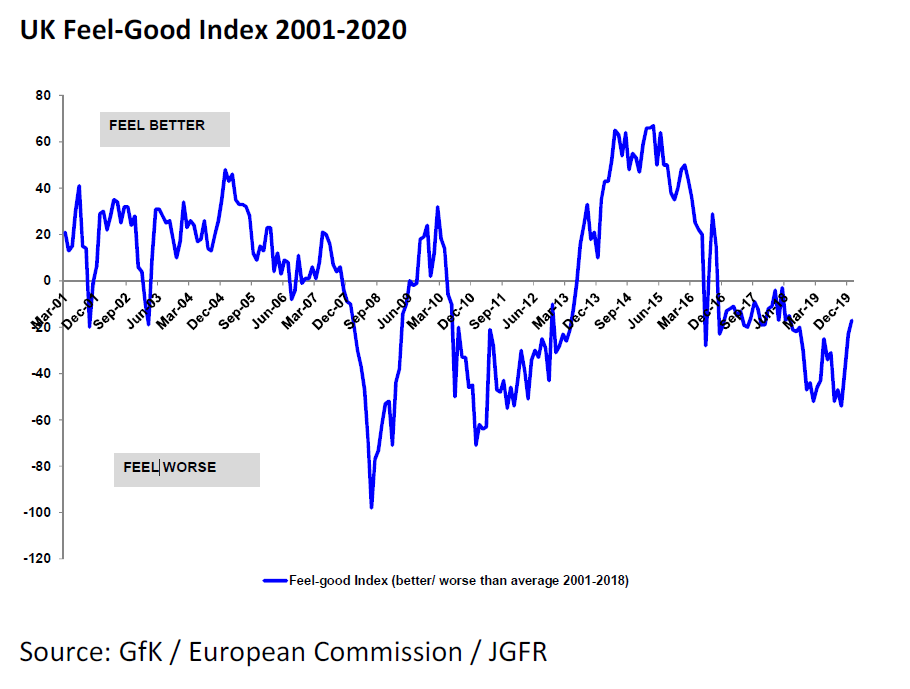

Feel-Good yet to return but people less downbeat although cautious with finances

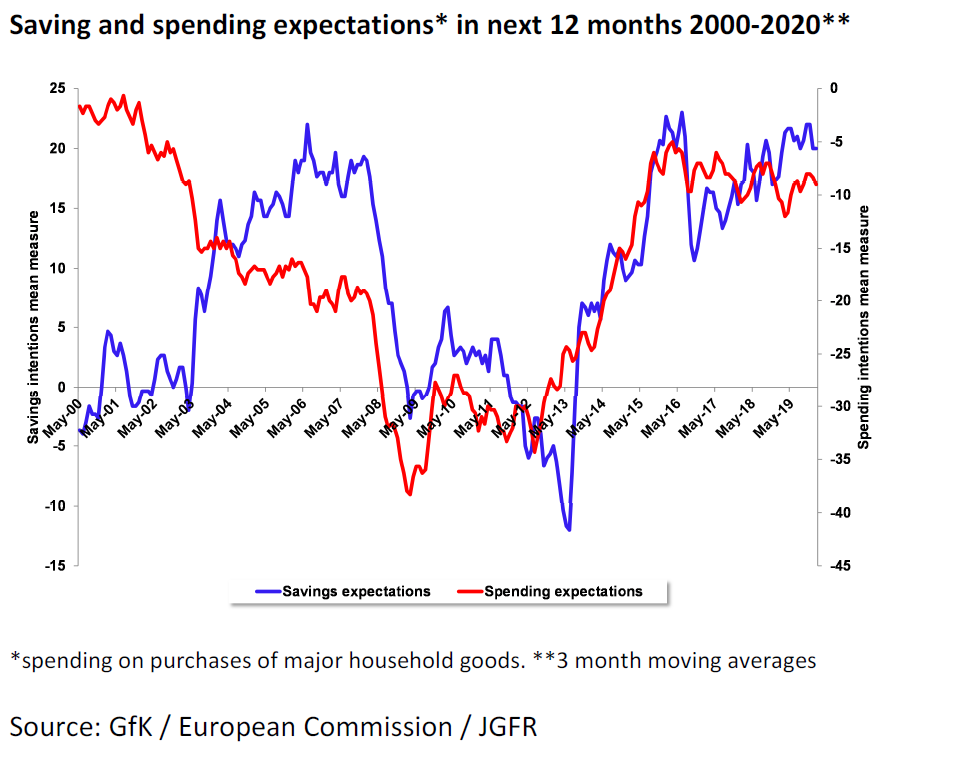

While economic optimism has improved over the past 2 months, reflected in a strong jump in the JGFR Feel-Good Index covering a range of forward looking indicators including general economic and personal finance expectations, a consumer spending boom seems unlikely as early indications point to consumers prioritising saving. Much will depend on employment holding up.

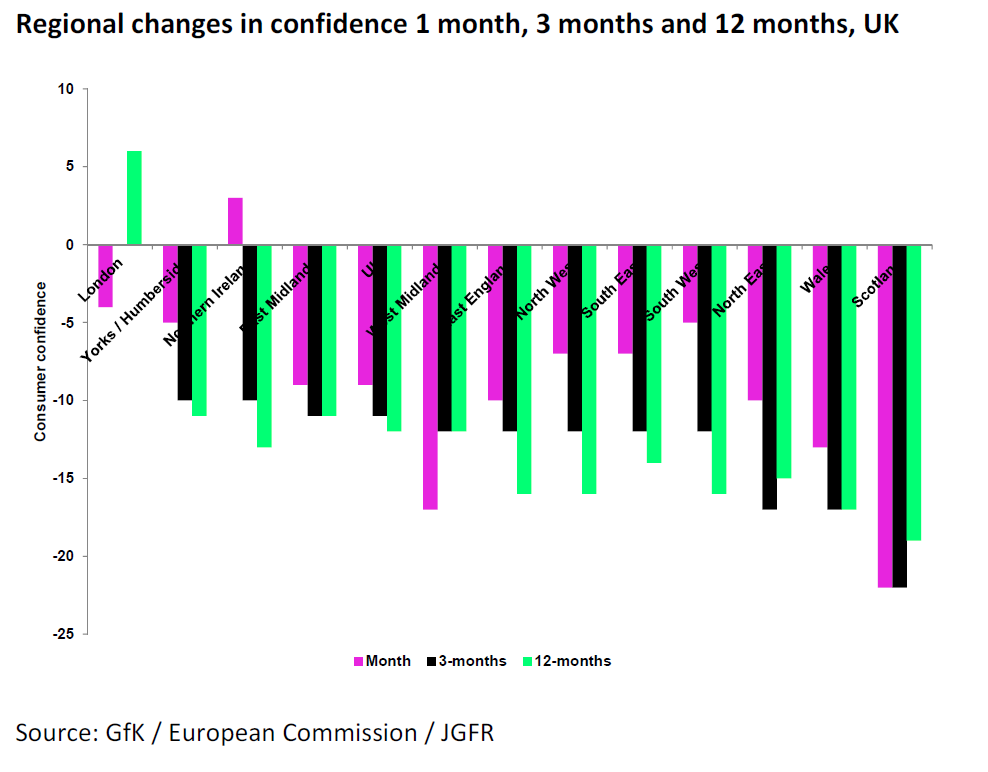

Brexit bounce in 6 of 9 English regions

Confidence has varied considerably across regions over the past 12 months. For most of the year Londoners confidence has been in positive territory whereas all other regions sentiment has been negative.

In the month since the general election there is evidence of a Brexit bounce across all 3 northern regions with January confidence in the north up 9 points on the month to -7, above the UK average (-9) . The South West (7

points up at -5) , the South East (4 points up at -7) the East of England (5 points higher at -10) and Wales (4 points higher at -13) also saw bigger jumps in sentiment than the UK average (up 2 points).

Getting the Northern Ireland Assembly to work again will have helped the surge in Northern Irish confidence in January (21 points higher at +3. The Brexit result may see Northern Ireland becoming ever more in the news,

being the only land border with the EU.

Regions where the general election vote had a negative impact on sentiment were London (13 points down at -4), the West Midlands (7 points down to -10) and Scotland (1 point down at -22). Both London and Scotland

voted to remain, with the mood among Scots by far the most negative since the 2016 Referendum. Londoners may have been under the impression that Brexit will not happen but they will now have to adjust to a new post-Brexit era with pressure on the government to focus more on boosting regional growth away from London and the South East.

Car manufacturing will become a barometer of Brexit Britain. Not only will the UK tariff -free part of the European car supply chain be under threat, but the lack of battery manufacturing support will restrict domestic production of electric vehicles. The drop in sentiment in the West Midlands (leave supporting) may reflect worries about the future of the regional car industry.

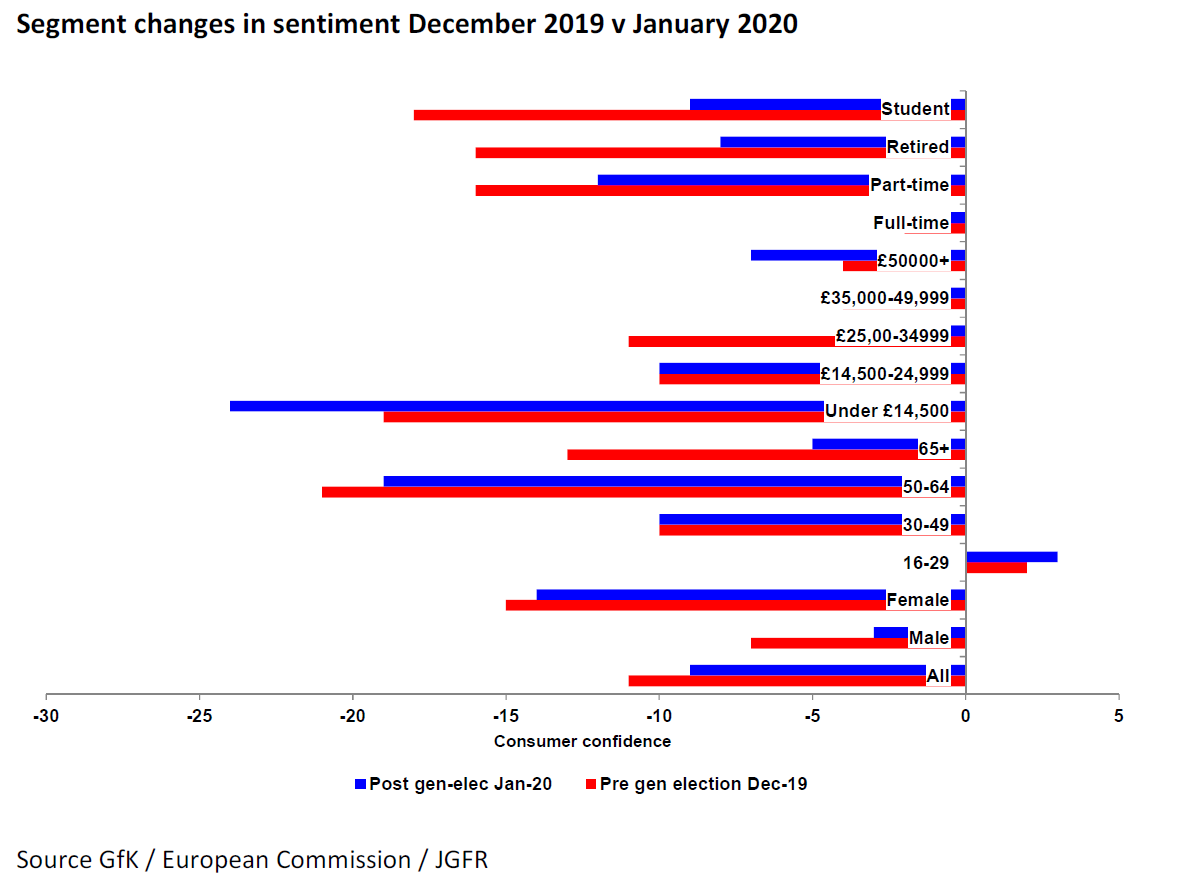

Changes in pre and post-election sentiment: December 2019 – January 2020

Brexit uncertainty has been a major factor across segments in reducing confidence during the past 12 months, especially in the current and future general economic situation component measures. Worries about low growth in the economy have reinforced the pessimistic economic view.

Across most segments there is an improvement in confidence between December and January, although this is normal as the New Year provides a psychological new start. Notable bounces in confidence that may be Brexit related are among the over 65s (up 8 points to -5) and among lower/middle earners with household income between £25,000-34,999, jumping 9 points to -2.

Not all segments appear content with the certainty of the general election result. At both ends of the household income scale confidence fell; in the lowest income band by 5 points to -24, and in the top income band by 3 points to -7. Many in the lowest income band may have been hoping for a

Labour government and its promised spending largesse; in the top income band the lack of certainty that leaving the EU will have on maintaining high paying jobs, especially in London. Confidence among full-time workers shed 1 point to -3 a lukewarm response to greater Brexit certainty.

The general election did little to narrow the gender confidence gap in men’s favour (up from 8 points in December to 11 points in January). This gap in confidence between the sexes remains a feature of the mood of the nation. The change in pension age affecting WASPI women will be one factor as it is

also reflected in the much weaker level of confidence among the 50-64 age-group.

Democracy in action: General Election V Referendum

As the UK bids farewell to the EU it will do so with the country still divided but forced to accept the 2016 Referendum result by way of a general election rather than a second referendum or Peoples Vote.

While the polls in the run up to the general election showed the single issue ‘Get Brexit done’ Conservative Party mantra well ahead of a Labour party trying to fight a general election on traditional policy-based grounds (and pushing the Lib Dems into committing electoral suicide) the political geography of the UK showed a clear preference for leave among constituencies by almost two to one. This meant the prize of winning in leave seats on the’ Get Brexit done’ mantra would translate into automatic majority government.

That Boris Johnson managed to negotiate a revised Withdrawal Agreement with the EU and finesse a general election and neuter the Brexit party will be the source of much commentary in the coming years as historians review the road to Brexit.

While the convincing Conservative general election result (a 78-seat majority) sealed the January 31 departure, this has provided cover to another argument over share of vote. In the 2017 general election government ministers would always quote in media interviews when stating the case for Brexit that 80% of voters supported parties who would uphold the Referendum result.

In the December 2019 general election a majority of voters (53%) supported parties who favoured a second referendum to resolve Brexit but this outcome was conveniently overlooked. Using seats v votes to confirm the democratic will of the people’s 2016 referendum result has decreased further the trust of millions of the electorate in politicians (especially the young whose future is at stake).

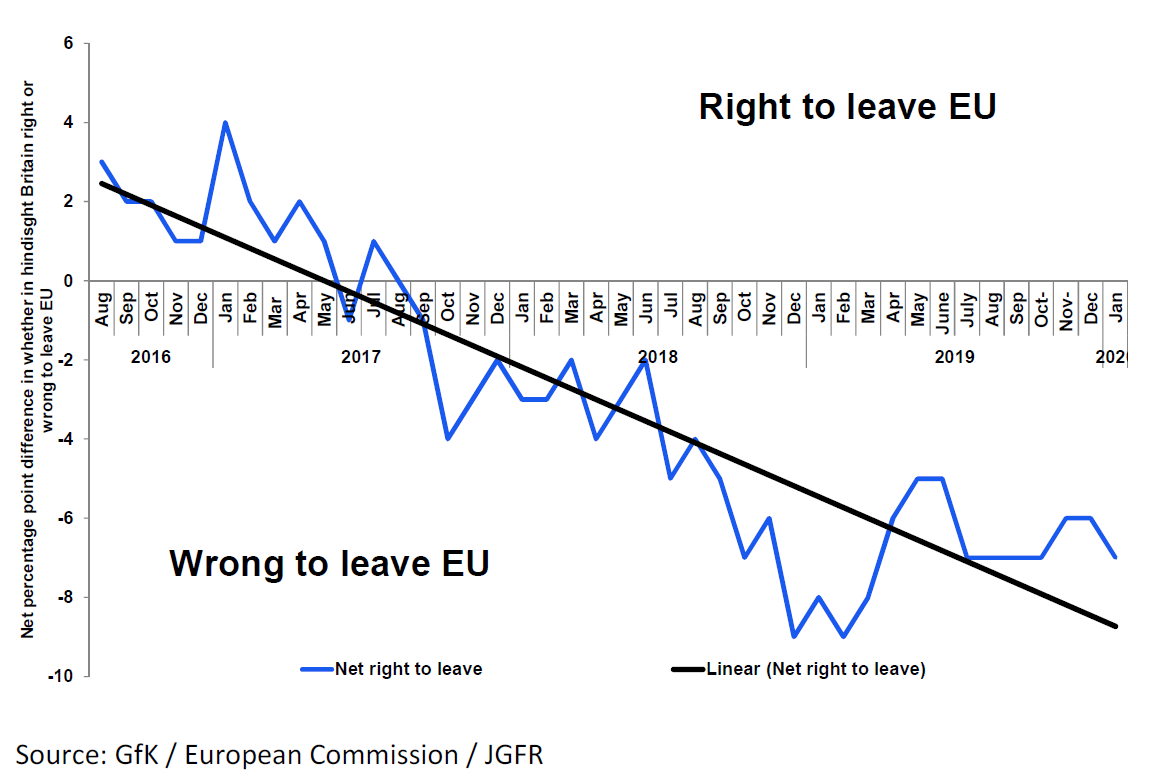

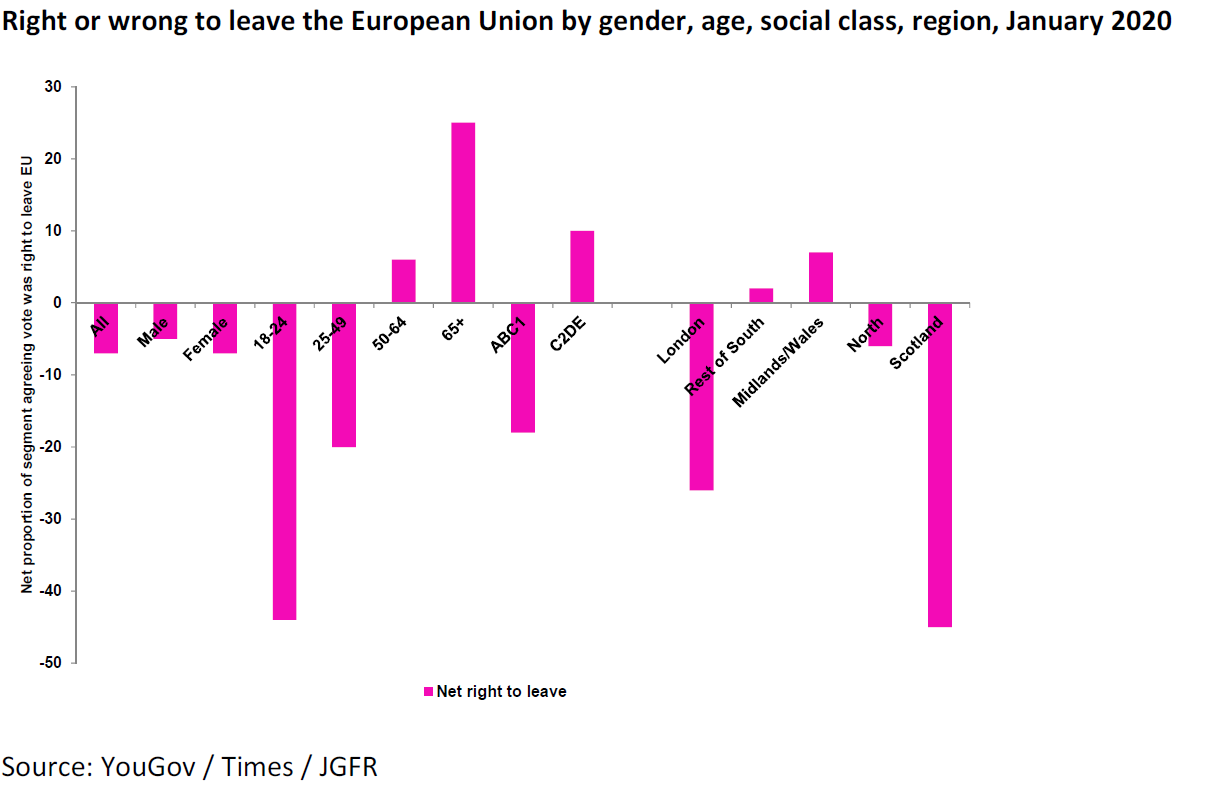

EU referendum: Right or wrong to leave the European Union 2016-2020

As the UK leaves the EU at 11 pm on January 31st 2020 the last pre-Brexit YouGov tracker undertaken between 24-26 January show more people consider the UK wrong to vote to leave the EU by a majority of 47% to 41%. There has not been a majority believing the referendum result was

right since the summer of 2017.

Both a majority of men and women believe the UK was wrong to vote to leave the EU, but are far outscored by the proportion of under 40s who believe that the UK was wrong to vote to leave the EU. A net 44% of 16-29 year olds and a net 20% of 30-49 year olds believe that to be the case. Once

again the generations are conflicted with the working young defeated by the pensioner vote.

By socio-economic class and region the evidence continues to show that the country is vulnerable to a greater post-Brexit division as people (especially the young) loose trust in politicians to safeguard their futures, even more so with regard to climate change and the environment.

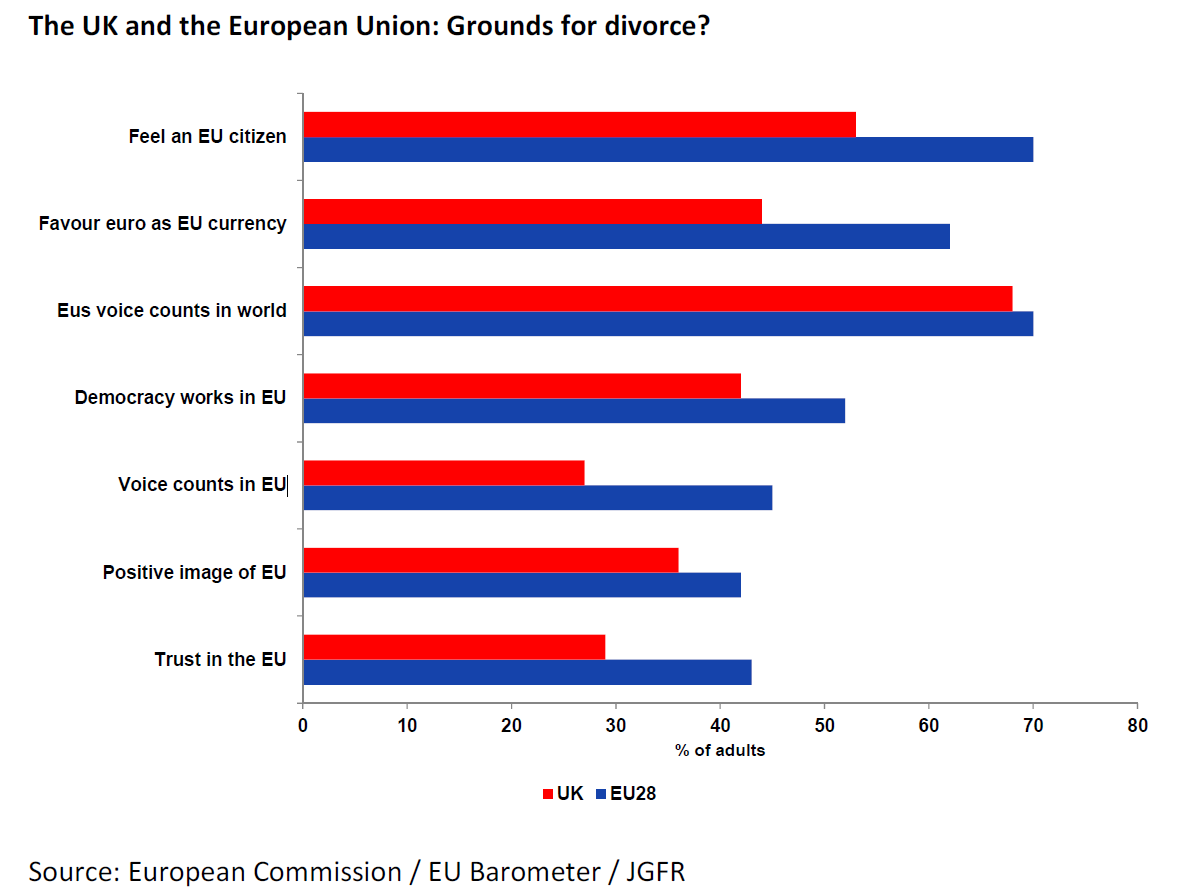

Go Europe? The view of European citizens and the UK position within the EU

Twice a year the European Commission produces a Eurobarometer that take the pulse of Europeans through polls carried out in the EU 28.

In the latest Eurobarometer (92) undertaken in October / November 2019 the public across the 28 member states were asked about their views on a wide range of topics.

The attitude of the UK public to Europe is unsurprisingly among the most euro-sceptic of the EU28 which reflects the semi-detached status the UK enjoys, protected by a number of opt-outs negotiated by various Prime Ministers over the past 2 decades.

Moves to a Federal Europe involving European Economic and Monetary Union (EEMU) have long been a bridge too far for UK politicians with the opt out of joining the euro-area highlighting the desire for a looser relation with the EU. In the latest Eurobarometer a majority of Britons (56%) are

against the euro and the desire for EEMU (26% support), in contrast to a record 70% across the EU28 who favour EEMU with a single currency the euro (26% against).

Fewer people in the UK regard themselves as European citizens (53% – albeit a small majority) compared to 70% among the EU28, although a large majority (70% EU28, 68% UK) believe that the EU’s voice counts in the world. Power and influence in the 21st century appears set to reside in big

population blocks with the EU alongside the US and China. Exiting the European Union looks set to leave the UK more isolated as a medium sized country (albeit with nuclear weapons) and dependent on getting trade deals to boost the economy.

Across Europe trust in politicians whether in the EU, national governments or parliaments has faltered in recent years with democracy under threat as people feel their votes are not counting. The UK is the most sceptical of the EU28 about the way the EU has been run and the voice of MEPs who

(Nigel Farage apart) they rarely hear from.

While immigration is cited as a primary cause of people voting to leave the EU, the UK by comparison with many EU countries has been shielded from the waves of refugees landing on Europe’s southern shores. Immigration is the issue most concerning EU nationals (34%) compared to 25% in the UK (despite it being a major part of the Vote Leave campaign) with strong support for a common asylum system across the member states (66% v 55% UK) and to reinforce the EU’s external borders with more guards and coastguards (68% v 55%).

With declining birth rates across Europe the need for immigrants to bolster working age populations and boost growth will add to the difficulties of combating anti-immigrant sentiment. The post-Brexit immigration policy of the UK is set to be one of the controversial aspects of government policy and may well counter many of the reasons for Brexit. Indeed whether they voted or not in the 2016 Referendum many people may begin to wish that Brexit and its threat to their health and financial wellbeing had never happened. Now that getting Brexit done has been decided upon there is no

going back; only the extension of the transition period may delay the final departure, which the Johnson government has ruled out.

Relegation spot for UK as it bows out of European Union

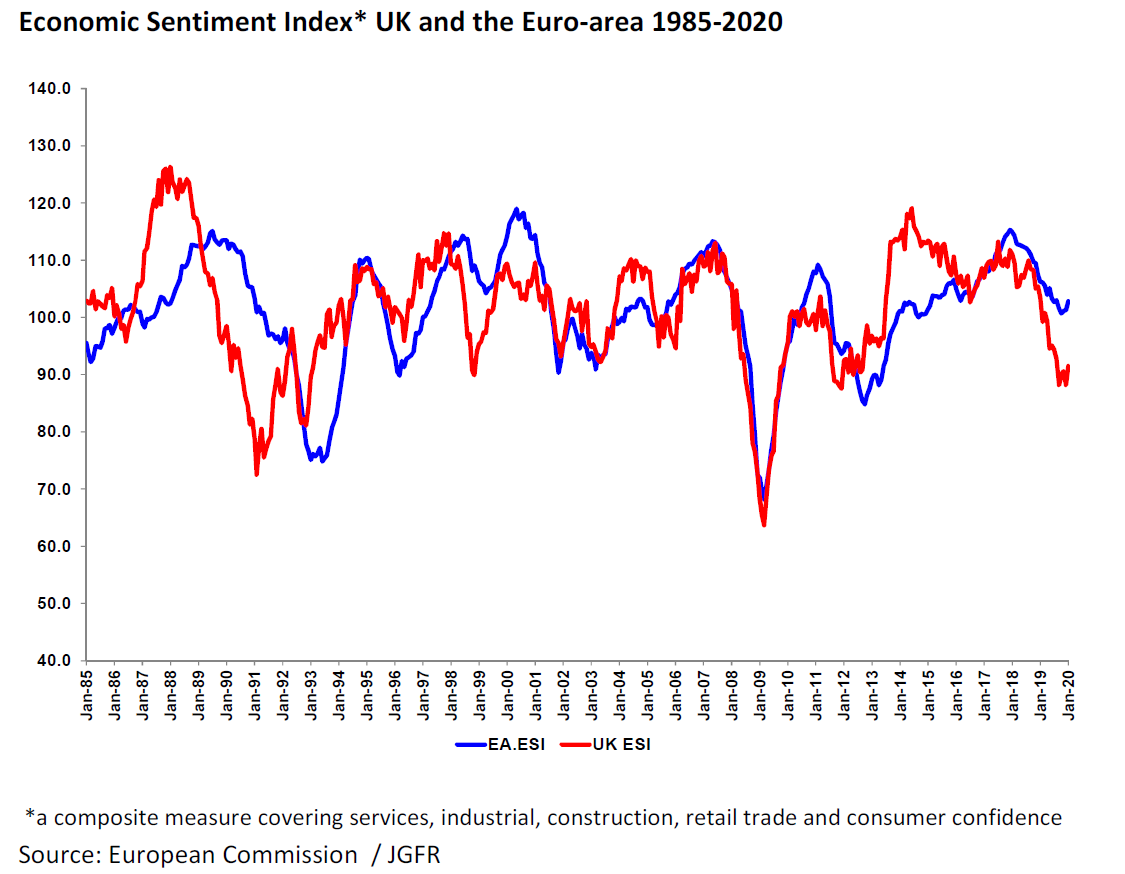

Every month the European Commission conducts large scale economic and business surveys across the EU 28 member states. From these datasets the EC publishes an Economic Sentiment Index for both the EU and the euro-area as well as for each of the 28 member states. In the past year as

growth and confidence in the UK economy faltered the UK ESI has slumped to the foot of the ESI league table and diverged notably from the euro-area ESI.

Over the past 35 years the UK and euro-area ESIs have experienced some similar patterns in direction (particularly in the financial crash of 2008-11) but at other times have diverged. Both the ESI average for the UK (101.7) and Euro-area (101.3) are very similar over the whole period but notably different over periods in the last decade. Between 2010 and the EU referendum in June 2016 UK ESI (103.2) exceeded euro-area ESI (99.2) as the latter suffered from the impact of the Eurozone sovereign debt crisis, but since the referendum euro-area ESI is notably higher (108.2) than the UK (103.9).

As the uncertainty surrounding Brexit grew during 2019 so the UK economy weakened relative to the euro-area with the UK ESI tumbling by 15.2 points from 103.4 in January 2019 to a bottom of 88.2 (a 10-year low) in December, rising to 91.5 in January 2020, but well adrift at the foot of the EU ESI Sentiment League table for the 3rd successive month. Over the same period the euro-area ESI fell, but by a lower amount, down from 106.2 in January 2019 to a 2019 low of 100.2 in October recovering to 102.8 in January 2020.

Brexit: a reboot for the economy?

Much of the Brexit debate has revolved around economics and the impact that leaving the EU will have on the future prosperity and wellbeing of the UK.

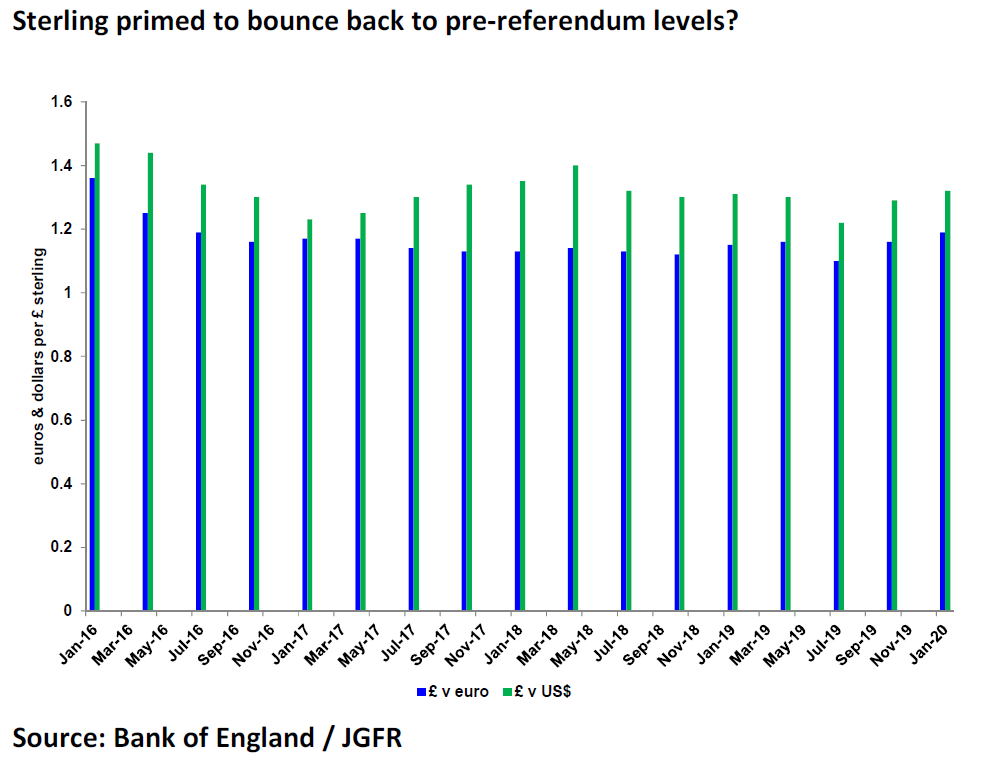

A number of’ hard’ data measures have been used to highlight how others regard the UK decision to leave the EU. In the wake of the vote to leave sterling and the FTSE 100 index reflected the shock of the Referendum vote and continue to trade below pre-Referendum levels.

In the 5 years since the Referendum bell sounded, sterling has fallen against the US dollar from £1 = US$ 1.47 to £1=US$ 1.32 on Brexit Day, a fall of 10%. Over the same period the value of sterling against the euro is down 12.5% from euro 1.36 = £1 to euro 1.19 = £1. Both have traded much lower.

With the UK leaving the EU the currency may become more vulnerable to pressures from financial markets especially if trade agreements become hard to negotiate and the Balance of payments becomes ever more hostage to the ‘kindness of strangers’.

UK stock markets have lacked sparkle since the EU Referendum relative to other markets, especially the US stock markets. The main FTSE 100 index closed down 3% at 6,138 on June 24th 2016 on a day of wild trading following the Brexit vote and over the subsequent 3 ½ years recovered to 7,286 on Brexit day, a gain of 18%. The more domestically focused FTSE 250 fell steeply on June 24th down 7% to 16,088 but has gained 31% to close on Brexit day at 21,143. By contrast the Dow Jones Index is up 66% from 17,400 to 28,895 over the 3 ½ years with tech stocks driving the index higher which is a key barometer of progress under the Trump Presidency.

UK growth and company prospects will have to improve considerably to boost UK stock markets with much hope placed on new growth sectors: fintech, biotech, AI and infrastructure innovation especially in renewables Such is the confluence of a number of disruptive global changes / challenges underway that the UK may post-Brexit emerge well placed to be a leading player.

The growth question

Since the EU referendum UK growth has slumped from 2.5% in 2015 to 1.4% in 2019. The result of this fall off in growth is that the economy is some 2.5% to 3% lower than it would have been if Brexit had not happened according to the Institute of Fiscal Studies last October. The cost of Brexit to date

is some £55 -£65 billion with the nation’s wealth set to grow slowly in the coming years. The Bank of England recently published its 2020 and 2021 growth forecasts of 0.8% and 1.4%. It has also downgraded the economy’s potential growth rate to an underwhelming 1.1% a year.

Much of the heavy lifting of the economy to stimulate growth will be through public infrastructure projects and boosts to welfare spending. The Midlands and the North will be prime recipients on the back of the go-ahead for HS2.

As the government prepares for the key negotiations over a trade deal with the EU (and with the US) some of the Brexit uncertainty may be lifting with a number of surveys showing a pick- up in business sentiment. The CBI survey of manufacturing published in January reported the biggest positive swing in confidence on record (since 1958). Purchasing Managers surveys for January all show an improving outlook with the key services sector showing its strongest growth since September 2018.

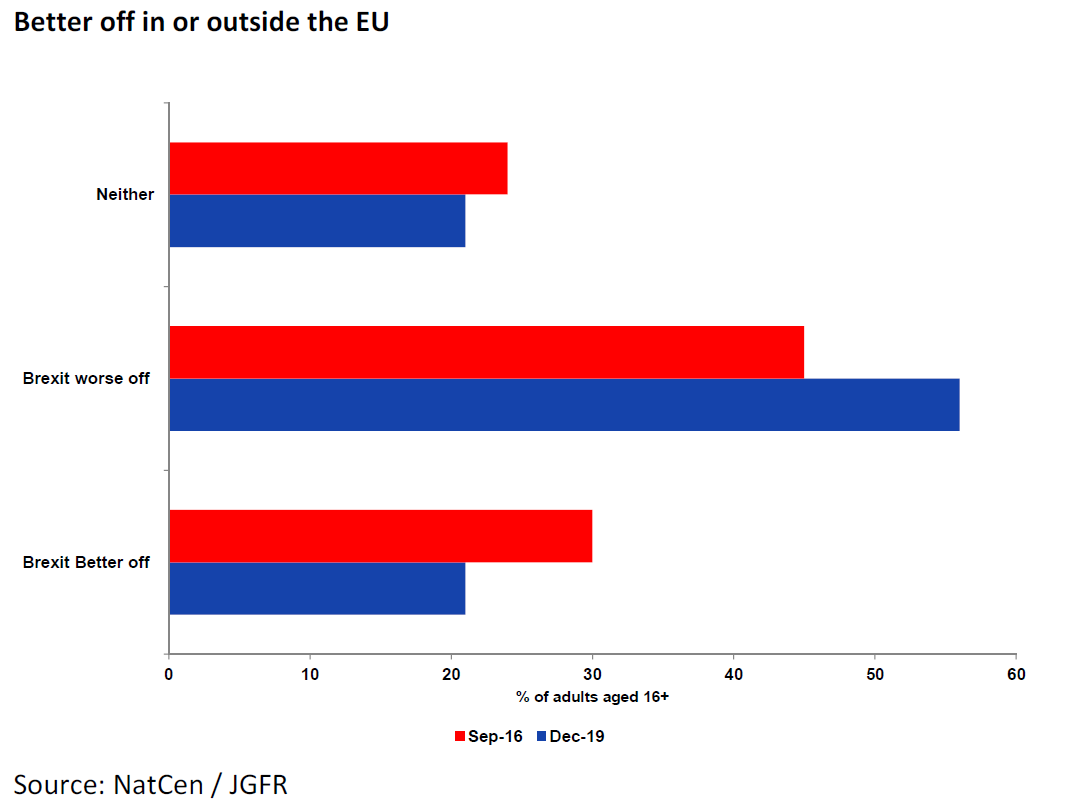

Only improved economic growth will lead to people feeling better off both mentally and financially. While optimism about the general economic situation has improved in the past 2 months, a large proportion of the public (56%, December 2019 up from 45% in September 2016) remain of the view that the economy will be worse off outside the EU.

Past surveys of the perceived impact on the personal / household situation of Brexit have shown a majority of people believing they will be worse off outside the EU. In anticipation of the UK leaving on 31 March last year a GfK / JGFR survey found 28% of adults believed they would be better off outside the EU with 40% believing they would be worse off and a large minority (32%) not knowing.

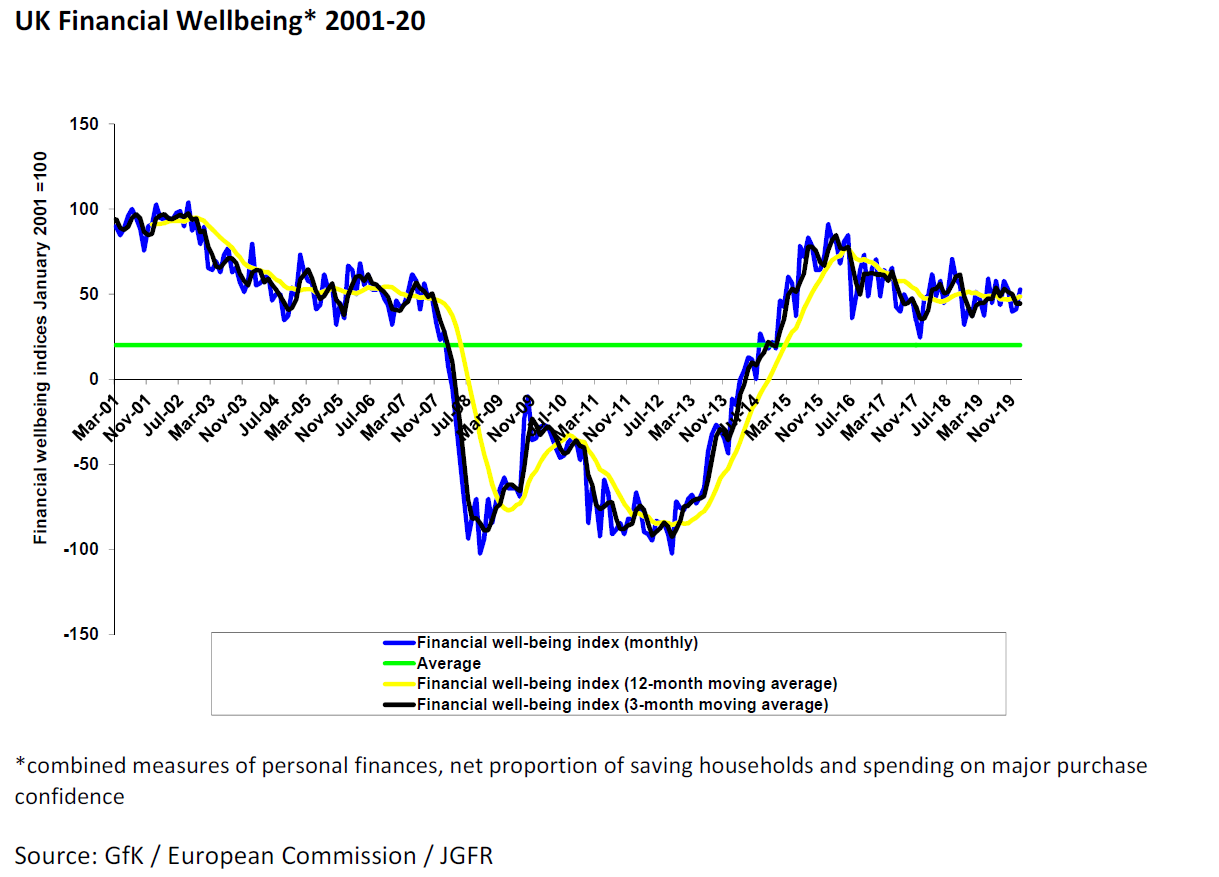

Since the EU referendum UK financial wellbeing has held up well with household finances at well above average levels on Brexit day.

Since the July 2016 referendum the JGFR Financial Wellbeing Index (FWI) has improved from +28 to +53, well above the 19 year average of +20, but below the June 2016 level of +85. Despite record levels of jobs being created since the Brexit vote, and real incomes rising in the past year, spending confidence has weakened reflecting more a general caution about the future than a notable drop in big ticket purchases, A more buoyant

housing market is a good indicator of future confidence and financial wellbeing with early survey signs showing greater activity.

While the financial wellbeing of the nation starts the new Brexit era in good shape, the health of the nation (both mental and physical) is under strain. The stresses of the past three years over Brexit will have taken their

toll on relationships and mental wellbeing which is now emerging as a major issue in workplaces and among young people. In the GfK / JGFR survey of attitudes to Brexit last March 60% of the public believed the nation’s health and wellbeing is being eroded by divisions and uncertainties over Brexit.

It is no surprise that health (44%) has now replaced Brexit/Europe (43%) as the major issue in the end of January YouGov ’ Issues facing the country tracker’, especially with the ongoing scares over the spread of coronavirus. It is the first time since the Brexit vote that a majority of the population do not regard Brexit as the major issue facing the country. Getting Brexit done appears to be getting through to the public although the hard work of transforming Brexit Britain is only just beginning.

Final thoughts on the road to Brexit

The past 3 ½ years has shown using a referendum with a binary choice to resolve the UK’s future direction to have been a time consuming and costly activity. Millions of the public wish Brexit had never happened with

trust in Parliament and politicians falling away.

A Pied Piper government has taken control but quite where the country is headed is unclear and even whether it will remain the United Kingdom. The influence of the UK is likely to reduce just when more co-operation /

collaboration on emerging issues is needed. Re-joining Europe may become the glue for realigning UK politics.

The US elections will cast a big shadow over global events this year; within the EU new political leaders will emerge who will have a vote on any EU-UK trade deal. For the UK crashing up against the transition departure

date seems inevitable. The Brexit uncertainty has in many ways only just begun as detailed sector by sector negotiations get underway with UK financial services likely to be at the centre of debate and a new battle

between London and the regions.

For the UK consumer 2020 is the start of a new decade that will see enormous change where the d word will dominate – data, disruption, demographics, democracy , debt, divorce, deluges, disease and sadly death as the number and power of baby boomers wanes and a new generation takes control. Confidence during the decade will be greatly tested.