John Gilbert shares the latest results from the monthly UK Consumer Confidence Barometer.

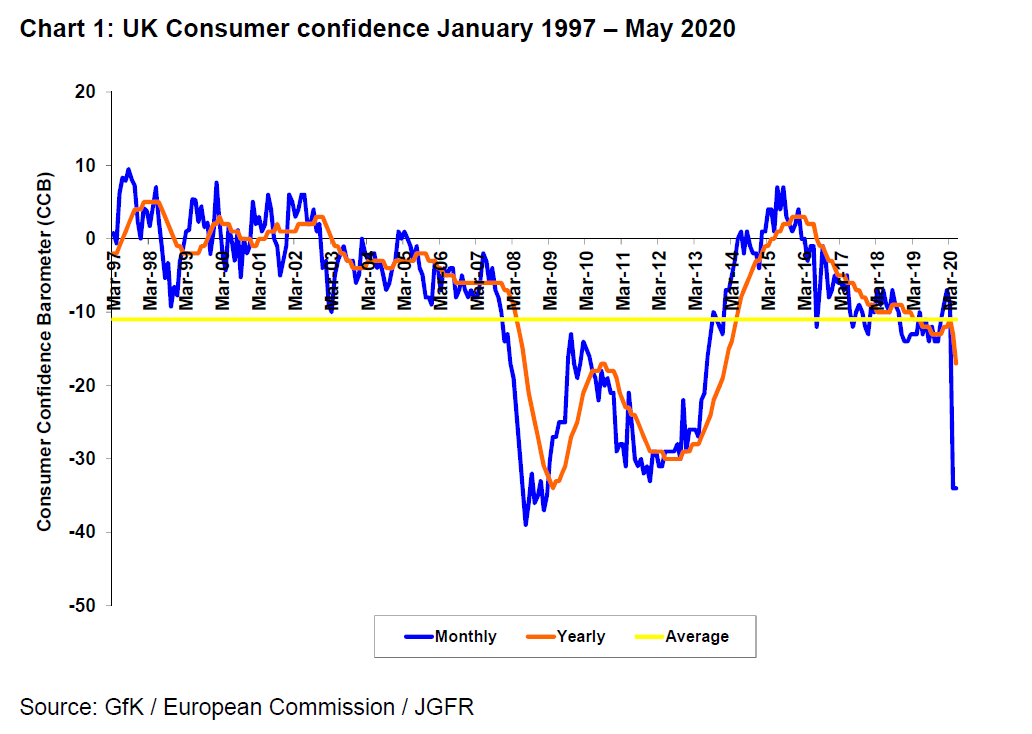

The monthly UK Consumer Confidence Barometer (CCB), undertaken by GfK on behalf of the European Commission*, is unchanged at -34 in May.

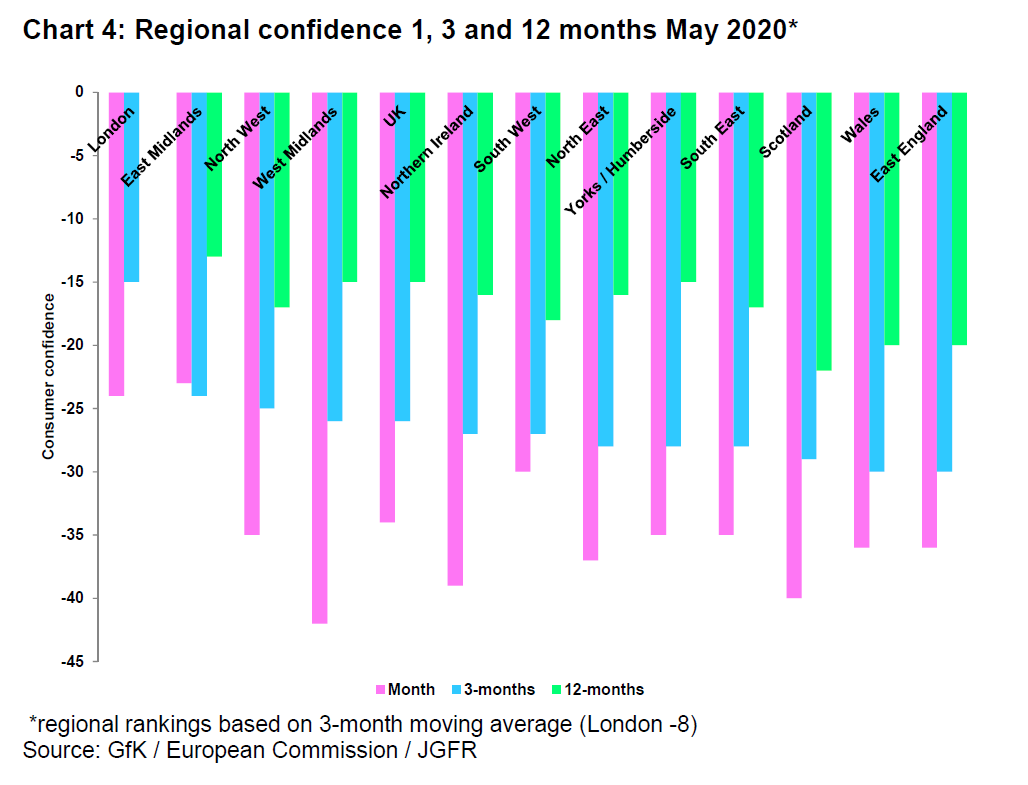

Confidence is up in 3 and down in 3 UK regions. Biggest shifts in sentiment are in Northern Ireland (down 12 points to -39) and Scotland (down 6 points to -40). Small gains occurred in the South (3points up to-30), Wales (3 points higher at-36) and the North (2 points up at -35). In the Midlands

sentiment dropped 1 point to -34.

Of the 5 sub-measures comprising the headline measure:

– The financial situation of households over the past 12 months is unchanged at -4 on the

month and 7 points lower than a year ago

– The expected financial situation of households over the next 12 months is 5 points higher at –9, but 14 points below a year ago (+5)· The general economic situation measure over the past 12 months slumped a further 11 points

to -55 on the month and is 25 points lower than in May 2019 (-30)

– The general economic situation measure in the coming 12 months edged up 2 points to -54

compared to April but is, down 25 points on May 2019 (-29)

– The measure of consumer sentiment to making major purchases in the current economic

gained 5 points on the month to -47, but is down 48 points on May 2019 (+1)

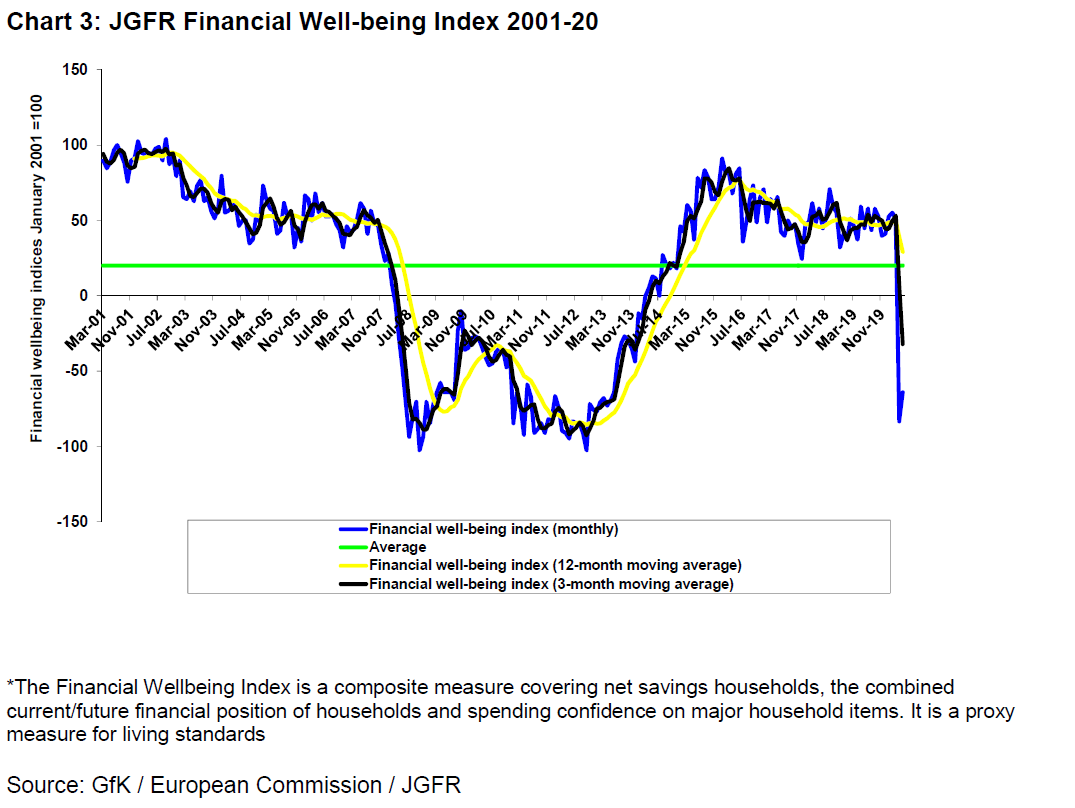

The survey also asks other questions about spending and saving. Expected spending on major purchases (such as furniture or electrical goods) in the next 12 months compared with the previous 12 months is 1 point up at -33 (-7, May 2019). Overall spending confidence on major purchases of

household goods declined 74 points on 12 months ago.

Saving confidence improved on the month. In May 59% of consumers are likely to save in the next 12 months, up from 56% in April but below 60% 12 months ago. More people believe it to be a good time to save (52% v 46% April but down on 53% a year ago). Compared to April (+23) saving confidence is 12 points higher (+35). Currently 58% of households are saving, up from 54% in April (unchanged, May 2019). Households overall financial position (+27) is 3 points up on the month (+26, May 2019)

and well above the long term average (+20).

The jobs outlook is very depressed,. The measure of unemployment expectations is 1 point worse at +51 on the month and down 29 points on a year ago (+22).. A higher score represents rising unemployment expectations. A net balance of 56% of adults (57%, April and 28% a year ago) believes unemployment will rise in the next 12 months. The measure of inflation expectations improved by 1 point to +94, but is 2 points worse than +92 a year ago and 22 points worse than the long term average (+72)

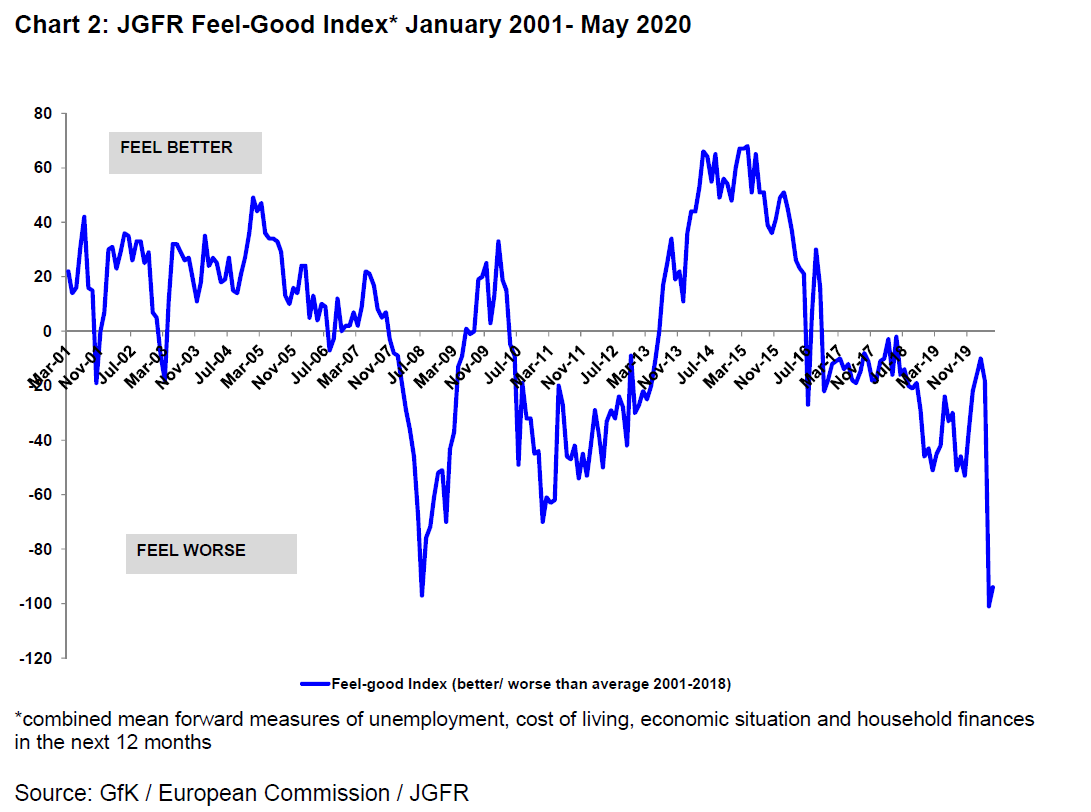

In May both the JGFR Financial Wellbeing and JGFR Feel-Food Indices improved on the multi-year lows both crashed to in April. The former is up 7 points to -94 (-24, May 2019) and the latter gained 19 points to -64 (+59, May 2019).

John Gilbert, Director, JGFR commented: “May’s CCB, undertaken in the first half of the month, will not reflect the initial relaxation of some

lockdown measures. Consumers are bunkering down for very tough times ahead with the lockdown orcing shifts in consumer behaviour. Getting consumers to spend will be a challenge for policy makers with activity now dominated by fear and caution with saving, paying down debt and cutting

expenditure current priorities. With so many jobs in sectors beset by social distancing measures, and until such measures can be relaxed safely, the economic outlook and confidence will stay very weak”

*The UK Consumer Confidence Survey was conducted by GfK NOP for The European Commission among a sample of 2,000 adults aged 16+, representative of the UK population, and carried out between 1-14th May 2020. Following Brexit on January 31 2020 The European Commission will

continue to collect UK data until the end of the transition period. It has already undertaken a detailed restatement of business and consumer surveys with the new methodology presented in the February

datasets.

The JGFR May UK Consumer Confidence Monitor will be published on Tuesday June 2nd.

Enquiries: John Gilbert 07740 027968 email: j.gilbert@jgfr.co.uk; twitter @JohnGilbertJGFR